Quickly before we dive into this subject, my last post was in praise for the serving tank. I got a lot a feedback from some people who thought I was crazy and that kegging beer or jacketed bright tanks was the ONLY way to go. I am writing these posts from the angle of building and running a quality brewery without spending a million bucks. Most of the readers are small brewery or brewpub owners. It’s not a one size fits all. OK, now where was I….?

If you work in a brewery, or if you own a brewery, have you ever thought about your endgame? I mean how do you see yourself in ten or twenty years? Ten years goes really fast and the ripples you start today can become giant waves in ten years, but you need to make that ripple first.

When I was younger I ran across a book called Retire at 35 - Cashing in on the American Dream, by Paul Therhorst. He described how through ultra frugal living, and maximizing your income, you could stop working for a paycheck well before retirement age. I had just opened my third restaurant (before our first brewery) and was working crushing hours, so this got my attention. Through what I read in the book my wife Sandy (teaching middle school - no easy feat) and I built a plan to get out of debt and start an aggressive savings plan.

The second book I read came out a few years later. This book was called Your Money or Your Life by Joe Dominguez and Vicki Robins. Their revolutionary book laid out a nine step program that has freed hundreds of thousands of people from debt and enabled them to go on to early retirement.

My first ripple was to get out of debt. We never had credit card debt because we paid off our cards each month. I did however have student loan debt. I can’t remember the payment amount but let’s say it was $50. I would double or triple it to pay it off early. As soon as it was paid off (college was much cheaper then) I would take the total amount I was paying and apply it to the next debt I had. So if that one was $75, I would pay that but also add the $150 I had been applying to the student loan to make a payment of $225. This paid off the next loan even faster. I repeated the process and in about three years we had paid off everything including cars, with the exception of our house mortgage.

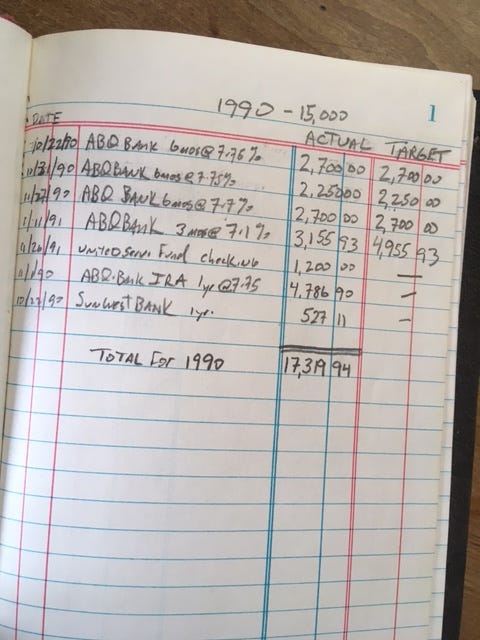

My second ripple was a small book I called my KMA (kiss my ass) Fund. In it I laid down a savings goal for the year, then broke it down into monthly savings. Next I tracked all the money we had made and spent, and put that amount in the book next to the savings goal.

Back then interest rates were crazy high, so all you needed to do was put your money in a CD or bond and you could make over 7%. Today that is impossible. Enter Mr. Money Mustache, and the FIRE movement. This is all the same philosophy that I was following, but a modernized version. For example, now it is better to invest in index funds than CD’s.

You are probably wondering what this has to do with brewing. Whether you are a brewer making a salary or you own your brewery, you need to make a plan with your income, no matter how small. In ten years you want to be at least in a place where if the shit hits the fan, you have no debt and enough in the bank to tide you over for a year. The truth is, if you fully embrace what is in these web sites, you could in ten years be brewing beer just because you want to, not because you have to for the simple reason that you are financially independent - having enough to not need a paycheck. This could allow you to open that dream farm brewery, or the lager brewery on a beach in Costa Rica, or even go around the world working in different breweries.

I know from experience that 99% of people will not do the steps necessary to make this happen, but some will. Start investigating this and you will find plenty of people with modest salaries and kids who achieve FI (Financial Independence) in as little as ten years.

Working in a brewery is a lot more fun, when you are doing it for the love of the craft and the pay is just a side benefit. I am working on a new book called, “A High School Graduates Guide to Financial Independence”. In it I go into nauseating details on how it can be done. By the way, my and Sandy’s ripple turned into a wave hit the beach in 1999. We continued to work and open breweries, but the amount of stress was way more manageable, and more fun.

If you find this at all useful, please subscribe so I don’t have to use Facebook (the evil empire) to advertise it. Also, if you have any comments let me know. Especially questions and article suggestions. Cheers, Tom Hennessy

As with many things, there are multiple ways to skin the cat (personally I'd never skin a cat but each to their own). When we first started we had a guy who owned the building we were helping renovate and despite getting a screwing by him (he was upfront with us that he was going to) he did give us our first start fresh out of school with a cool $100k+ in student loans. We had zero pesos to our name but used every last credit card to finagle our first frankenbrewery. We were ready to open but were out of money to buy our pizza ingredients so took all our furniture to the flea market and sold it even upselling a torchiere light for $30 that we had bought for $20. Took these dollars to Costco and opened. Even had enough left over to treat ourselves to some $.79 tacos! Anyways, once open and running our landlord who decided to secure his interest by demanding partial ownership (that we gave into) insisted we pay ourselves a salary from day one otherwise not worth being in the business. The reason I tell this story is that it is possible to bootstrap yourself into success; risky but what really do two 25 year olds with no kids have to lose? Fast forward and we kept that approach by taking out debt as long as we knew we could make more than the debt cost us! Our first $800k SBA loan ended up netting us enough to build our own place, ditch the original landlord (and buy back our shares), and then propel us into our second business. Again and again we did this maxxing out our available debt to grow faster than the debt cost us. Very stressful times with a tremendous amount of work but the one thing we always kept a close eye on us was what our efforts value was and if we exited at any time that the debt could be paid off and we'd be ahead. Nothing wrong with buying a million dollar brewhouse if it produces enough to make the business worth 5 million; you are an idiot to buy a $100,000 brewery that makes your business only worth $50,000! Whatever money you are investing into your business has to be making you multiples greater! Now writing this from the other side and other hemisphere of the world still building more breweries although not using commercial debt, we still look at it the same (if using personal funds it is still debt for the business, it just owes us vs a commercial lender). It all comes down to multiples. Even if you have a massive 20% interest rate, it is irrelevant if it allows you to make 5x more than what that debt costs you! Often opportunities are overlooked because of the fear of the risk and if you can make them work safely, go for it!

Tom's mention of the FIRE is very valuable. On Reddit there is a great FIRE subreddit and lots to learn. There is no feeling greater than financial independence and there are many ways to achieve it.

Now the big question/challenge is how to reprogram ourselves to stop taking on projects and stop working so hard. Easier said than done because there is so much ripe fruit ready for the picking!

Thanks again for taking the time to write these articles, much appreciated!

Looking forward to getting “A High School Graduates Guide to Financial Independence”. Do you know when it will be available? I’ll make sure my daughter reads it too when she gets a little older👍👍

I’m on the same page with you regarding saving/investing, cheers!