Fun With Profit & Loss Statements

When you are opening a brewery, probably a Profit and Loss statement (P&L) is fairly close to the bottom of your list. And in a way, rightly so as you have a whole lot more on your plate to deal with. But I want you to consider - and understand - this, which will make your business make a lot more sense, once you ARE up and running.

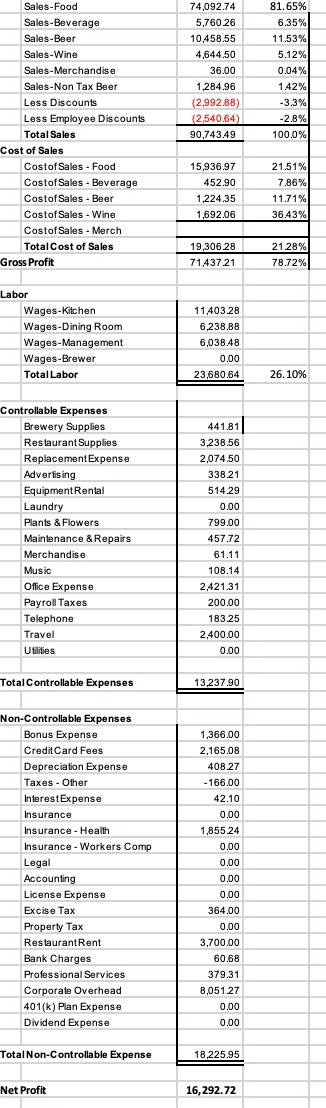

For starters, I like to look at a P&L as your prioritized “to-do” list. Think about it: The very first thing listed are sales, and what’s more important than that??

This is followed by cost of sales. By this I mean the actual cost to make what you sell. Don’t over think this. For example, I look at beer and I only include grain, hops, yeast, and if doing something strange, some sort of adjunct. I don’t include water (too complicated to calculate) or finings, filter pads, or whatever you add to make your beer sparkle. Same goes for chemicals to clean up. Those are all brewing supplies in my book. I’ve talked about how to calculate your inventories and cost of sales before so I’m not gong to repeat it here, but I will say that the P&L should give you a % of what your costs are by dividing the cost by the sales of that item. In other words, for beer cost, I don’t want to divide that cost by total sales. That wouldn’t be consistent or accurate. I want to divide that cost by Beer sales only. So if I have a goal of 12% beer cost (.12 on the dollar) and it comes out to 13%, I know I have a problem, and I need to find out if ingredients have gone up, or I didn’t count correctly on my inventory, or the bar staff is giving too much beer away. Same goes for all the other things I sell.

Your third biggest cost is labor. That’s why when I talk about the Scoreboard, it only tracks Sales, Cost of Sales, and Labor. Everything else, while important, isn’t gong to effect the bottom line like these babies will.

So then we get into all the rest of the expenses. I divide them into two lists: The first is called Controllable. That’s because these costs you or your managers can actually control. Like repairs, or utilities. There will come a time when you expand and it isn’t you and your spouse there working every night. With managers, you want to have a system where you can bonus them, not only on profits, but also how they work on the expenses that they can actually control.

The second part is called Non-Controllable, and like the title say’s, these are expenses that the manager can’t control. Things like rent, credit card fees, insurance and the like. You don’t want to penalize your managers for things that YOU control. But the bonus system is a whole other topic.

When you set up your accounting system at the beginning using something like Quickbooks, you can make your P&L’s reflect this. You don’t have to know how to do this. Hire a bookkeeper for $50 to $75 an hour. They can set all this up. I also like to use the bookkeeper to come in at the end of the month to calculate taxes and deal with that. I will screw that up. I will however use the accounting software to enter my daily sales and checks I write, and do payroll as well. \

When it’s all said and done, it will look like this.

Do these little things at the beginning, and down the road your books will be much cleaner and easier for you to make sense of.